Highlights

- 123,000 gross acres (2,670 net royalty acres) predominately in the core of the Midland basin;

- Adds 600 boe/d of US production in 2024;

- 85% liquids weighted production stream;

- 40% increase to Freehold’s Permian land position; and

- 25% increase to Freehold’s US drilling inventory.

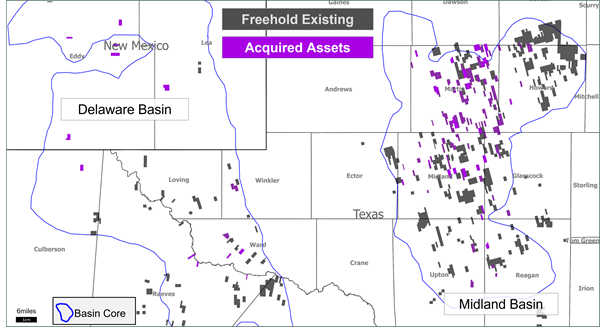

CALGARY, Alberta, Dec. 11, 2023 (GLOBE NEWSWIRE) — Freehold Royalties Ltd. (Freehold or the Company) (TSX:FRU) has entered into definitive agreements with two private sellers to acquire high quality Permian mineral title and royalty assets located in the Midland basin in Texas and the Delaware basin in New Mexico and Texas (together, the “Acquired Assets”) for approximately $112 million (the “Acquisitions”), net of estimates for exchange rates and customary closing adjustments. All references in this news release to dollar amounts are in Canadian dollars unless otherwise indicated.

The Acquired Assets are located primarily in Martin County Texas within the Midland Basin capturing some of the thickest stacked pay reservoir quality in North America, with up to ten benches available for development under current practices. Additionally, the Acquired Assets have a significant weighting to undeveloped lands, which is expected to maximize development and recoveries. Future development will be led by a strong portfolio of well capitalized operators with this core inventory ranking as some of the best within their portfolio.

Acquired Asset highlights include:

- Approximately 123,000 gross acres concentrated in the core of the Permian basin, comprised of 2,670 net royalty acres (normalized to 1/8th); 76% Midland, 24% Delaware. Upon closing the Acquisitions, Freehold’s total Permian land position will increase by 40% to greater than 0.5 million gross acres and will represent approximately 57% of Freehold’s US gross land base. Over 40% of the Acquired Assets net royalty acres are undeveloped, providing significant future activity potential.

- 2024 forecast average production of 600 boe/d, generating funds from operations of approximately $15 million (assuming current commodity prices and exchange rates), increasing Freehold’s Permian production by approximately 30% and the Company’s US production by 12%.

- 85% liquids weighted based on production, versus Freehold’s Q3-2023 average US liquids weighting of 78% and the Company’s total liquids weighting of 63%, providing meaningful uplift to Freehold’s average realized price and sustainability of returns.

- Strong well performance with average 365-day initial gross production rates of approximately 600 boe/d per Permian well (based on average performance of wells drilled in 2020-2022 on the Acquired Assets).

- Multiple years of future upside, with greater than 2,000 gross development locations identified. Upon closing the Acquisitions, Freehold’s total US inventory is expected to increase by 25%, bringing the Company’s total proforma US inventory to greater than 10,000 gross locations. This implies approximately 17-years of drilling inventory based on 2022 drilling levels.

- Future development is underpinned by some of North America’s top operators with the combined Exxon Mobil and Pioneer Natural Resources expected to move into Freehold’s top five payors and represent greater than 25% of future gross locations within the Company’s US inventory. Additional payors from the Acquired Assets include other large well capitalized producers such as Marathon Oil, Endeavor Energy Resources LP and Diamondback Energy.

- The Acquisitions are expected to double Freehold’s Midland basin activity and on a proforma basis, with one in every seven wells drilled in 2023 year to date in the Midland basin of the Permian will have occurred on Freehold’s lands.

Acquired Assets

The Acquisitions will be funded through the utilization of Freehold’s existing credit facility and are expected to close in January 2024. Freehold will provide an update on its 2024 guidance as part of its 2023 year-end operating and financial results, which are expected to be released after market close on February 28, 2024.

The Acquisitions are consistent with Freehold’s strategy of positioning its portfolio ahead of the drill bit in high quality resource plays and complements the Company’s existing North American asset base. We expect the addition of the Acquired Assets will contribute enhanced returns and sustainability to shareholders for multiple years into the future.

For further information, contact:

Freehold Royalties Ltd.

Matt Donohue

Investor Relations & Capital Markets

t. 403.221.0833

f. 403.221.0888

tf. 1.888.257.1873

e. mdonohue@freeholdroyalties.com

w. www.freeholdroyalties.com

Forward-Looking Statements

This news release offers our assessment of Freehold’s future plans and operations as at December 11th, 2023 and contains forward-looking information including, without limitation, forward-looking information with regards to Freehold’s anticipated land position upon closing the Acquisitions; 2024 forecast average production and funds from operations; the expected timing for closing of the Acquisitions; the expected attributes and benefits to be derived by Freehold pursuant to the Acquisitions; expectations that the undeveloped land acquired pursuant to the Acquisitions will maximize development and recoveries; Freehold’s anticipated Permian land position following closing of the Acquisitions; anticipated development locations with respect to the Acquired Assets; anticipated increases to Freehold’s Permian production and US production as a result of the Acquisitions; expectations that the Acquisitions will enable enhanced returns and sustainability to shareholders for multiple years into the future; the anticipated sources of funding for the Acquisitions; expectations that Exxon Mobil and Pioneer Natural Resources will move into Freehold’s top five payors and represent greater than 25% of future gross locations within the Company’s collective US inventory; the anticipated proforma ratio of wells drilled on Freehold’s lands in the Midland basin of the Permian; and anticipated timing of Freehold’s updated 2024 guidance.

This forward-looking information is provided to allow readers to better understand our business and prospects and may not be suitable for other purposes. By its nature, forward-looking information is subject to numerous risks and uncertainties, some of which are beyond our control, including the impact of general economic conditions including inflation and interest rates, the impact of supply chain and labour shortages, industry conditions, volatility of commodity prices, currency fluctuations, imprecision of reserve estimates, royalties, environmental risks, taxation, regulation, changes in tax or other legislation, the impacts of global political events such as the Russian-Ukrainian war and the Israeli-Hamas war on the supply and demand of oil and natural gas, competition from other industry participants, the lack of availability of qualified personnel or management, stock market volatility, our ability to access sufficient capital from internal and external sources. The closing of the Acquisitions could be delayed if Freehold or the other parties are not able to obtain the necessary regulatory and stock exchange approvals on the timelines anticipated. The Acquisitions may not be completed if these approvals are not obtained or some other condition to the closing of the Acquisitions is not satisfied. In addition, to the extent any title defects are discovered and unremedied it may result in Freehold not acquiring all of the assets expected to be acquired pursuant to the Acquisitions. Accordingly, there is a risk that the Acquisitions will not be completed within the anticipated time or at all. Risks are described in more detail in Freehold’s annual information form for the year ended December 31, 2022, which is available under Freehold’s profile on SEDAR+ at www.sedarplus.ca.

With respect to forward looking information contained in this press release including relating to the 2024 forecast production and 2024 forecast funds from operations from the Acquired Assets, we have made assumptions regarding, among other things; future oil and natural gas prices (for the purposes of the estimates in this press release we have assumed a 2024 WTI price of US$70/barrel of oil and a 2023 NYMEX natural gas price of US$3.00/Mcf); future exchange rates (for the purposes of the estimates in this press release we have assumed an exchange rate of US$0.73 for every CDN$1.00); that drilled uncompleted wells will be completed in the short term and brought on production; that wells that have been permitted will be drilled and completed within a customary timeframe; expectations as to additional wells to be permitted, drilled, completed and brought on production in 2024 based on Freehold’s review of the geology and economics of the plays associated with the Acquired Assets; expected production performance of wells to be drilled and/or brought on production in 2024; the ability of our royalty payors to obtain equipment in a timely manner to carry out development activities; the ability and willingness of royalty payors to fund development activities relating to the Acquired Assets; and such other assumptions as are identified herein.

You are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward looking information. We can give no assurance that any of the events anticipated will transpire or occur, or if any of them do, what benefits we will derive from them. The forward-looking information contained herein is expressly qualified by this cautionary statement. To the extent any guidance or forward-looking statements herein constitute a financial outlook, they are included herein to provide readers with an understanding of management’s plans and assumptions for budgeting purposes and readers are cautioned that the information may not be appropriate for other purposes. Our policy for updating forward-looking statements is to update our key operating assumptions quarterly and, except as required by law, we do not undertake to update any other forward-looking statements.

You are further cautioned that the preparation of financial statements in accordance with International Financial Reporting Standards requires management to make certain judgments and estimates that affect the reported amounts of assets, liabilities, revenues, and expenses. These estimates may change, having either a positive or negative effect on net income, as further information becomes available and as the economic environment changes.

Drilling Locations

This press release discloses anticipated future drilling or development locations associated with the Acquired Assets, all of which are currently considered unbooked locations. Unbooked locations are generated by internal estimates of Freehold management based on prospective acreage and an assumption as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Unbooked locations have been identified by management as an estimation of the multi-year drilling activities on the Acquired Assets based on evaluation of applicable geologic, seismic, engineering, historic drilling, production, commodity price assumptions and reserves information. There is no certainty that all unbooked drilling locations will be drilled and if drilled there is no certainty that such locations will result in additional oil and gas reserves, resources, or production. Freehold has no control on whether any wells will be drilled in respect of such unbooked locations. The drilling locations on which wells are drilled will ultimately depend upon the capital allocation decisions of royalty payors who have working interests in respect of such drilling locations and a number of other factors including, without limitation, availability of capital, regulatory approvals, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While certain of the unbooked drilling locations have been de-risked by drilling existing wells in relative close proximity to such unbooked drilling locations, other unbooked drilling locations are farther away from existing wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production. Upon purchase of the Acquired Assets, Freehold will have the reserves associated with the Acquired Assets evaluated by an independent qualified reserves evaluator in accordance with the requirements of National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities and it will be determined at such time whether any of the unbooked drilling locations disclosed herein are booked for the purposes of such evaluation with associated proved or probable reserves.

Production

All production disclosed herein is considered net production for the purposes of National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities, which includes Freehold’s working interest (operating and non-operating) share after deduction of royalty obligations, plus our royalty interests. Since Freehold has minimal working interest production, net production is substantially equivalent to Freehold’s royalty interest production. In 2024 net production from the Acquired Assets is expected to consist of approximately 65% of light oil, 20% of natural gas liquids and 15% of natural gas.

Initial Production Rates

References in this press release to initial production rates, other short-term production rates or initial performance measures relating to new wells are useful in confirming the presence of hydrocarbons; however, such rates are not determinative of the rates at which such wells will commence production and decline thereafter and are not indicative of long-term performance or of ultimate recovery. In addition, the average 365-day initial gross production rates associated with the Acquired Assets have been based on disclosure made by operators in the area and Freehold cannot confirm whether such rates represent the average of all wells drilled or are representative of only a selection of such wells. While encouraging, readers are cautioned not to place reliance on such rates in calculating the aggregate future production from the Acquired Assets.

Conversion of Natural Gas to Barrels of Oil Equivalent (BOE)

To provide a single unit of production for analytical purposes, natural gas production and reserves volumes are converted mathematically to equivalent barrels of oil (boe). We use the industry-accepted standard conversion of six thousand cubic feet of natural gas to one barrel of oil (6 Mcf = 1 bbl). The 6:1 boe ratio is based on an energy equivalency conversion method primarily applicable at the burner tip. It does not represent a value equivalency at the wellhead and is not based on either energy content or current prices. While the boe ratio is useful for comparative measures and observing trends, it does not accurately reflect individual product values and might be misleading, particularly if used in isolation. As well, given that the value ratio, based on the current price of crude oil to natural gas, is significantly different from the 6:1 energy equivalency ratio, using a 6:1 conversion ratio may be misleading as an indication of value.

Net Royalty Acres

The term net royalty acres is a term commonly used by US oil and gas companies in describing royalty interests in land. The net royalty acre calculation is a means of normalizing the royalty lands to assume that all lands are leased at a 1/8th (or 12.5%) lease royalty rate. For instance, if Freehold has a 1/4th (or 25%) lease royalty rate on one net mineral acre it would be considered two net royalty acres.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/159d9b07-c38f-46a2-a376-1c4913564142